smci stock Super Micro Computer Inc., commonly referred to by its ticker SMCI, has drawn attention in financial markets as a leading provider of server systems, particularly those tailored for artificial intelligence workloads. Based in San Jose, California, the company’s foundation in servers, storage systems, and management software has positioned it squarely in the heart of the expanding AI and enterprise data center infrastructure demand. In recent years, smci stock s operational focus on high-performance GPU servers, including liquid-cooled systems, has attracted major customers such as xAI, Tesla, and other hyperscale cloud players. This specialization has fueled explosive revenue growth, even as lingering concerns about governance, financial reporting, and accounting practices have tempered market enthusiasm.

Stellar Revenue Growth and AI-Driven Demand

Over the course of fiscal year 2024 and the first half of 2025, SMCI has demonstrated breathtaking revenue momentum. Annual revenue for 2024 nearly doubled year-on-year to about $15 billion. The first two quarters of 2025 alone brought in approximately $11.6 billion, effectively matching the entire previous year’s haul within just six months. This surge has largely been powered by demand for AI infrastructure, with clients such as xAI—constructing the massive “Colossus” supercomputer—relying on smci stock ’s servers to deliver high-density GPU compute capabilities. Major enterprise partners like Tesla and strategic alliances in Saudi Arabia further underscore the strength of demand for SMCI’s AI-centric offerings. Yet despite this growth, margins are shrinking. Gross profitability has dropped from around 18 percent in 2023 to 13.8 percent in 2024, and further declined to 11.8 percent by Q2 2025, pointing to intensifying price competition, rising costs, or saturation in certain segments.

Governance Challenges and Financial Reporting Headwinds

SMCI’s meteoric growth has not been without turbulence. In late 2024, Hindenburg Research alleged that the company engaged in accounting irregularities, including channel stuffing and related-party transactions. The auditor at the time, Ernst & Young, resigned amid concerns about internal controls and transparency. These controversies triggered investigations by both the SEC and the Department of Justice, while also placing SMCI on the verge of being delisted from Nasdaq. A special board committee subsequently found no evidence of fraud, and SMCI managed to file its delayed 2024 annual report by February 25, 2025, avoiding immediate delisting. However, the filing revealed significant material weaknesses in internal financial controls, prompting the company to commit to strengthening its audit and finance infrastructure. Despite the narrow escape, skepticism remains, with analysts and investors closely watching whether management can fully restore confidence in its governance.

Recent Earnings Reveal Mixed Signals

The company’s Q4 2025 results delivered both upside and downside surprises. Revenue rose by 8 percent from the prior year to $5.76 billion, while adjusted earnings per share came in at $0.41, falling short of the expected $0.45. Forecasts for Q1 2026 showed similar softness, with sales guidance of $6.5 billion and earnings at $0.46 per share, both below consensus targets. Following the announcement, the stock dropped sharply—down approximately 18 percent to about $46.79. Looking ahead, management remains optimistic about full-year 2026, projecting at least $33 billion in revenue, up substantially from fiscal 2025’s expected $22 billion. These fi‑ nal‑year targets reflect a commitment to expanding the base of large data center clients and rolling out advanced data center building block solutions to improve deployment timelines. Yet whether this optimism will translate into realized earnings growth remains uncertain.

Analysts Remain Cautiously Optimistic—Growth Potential Tempered by Risks

Among brokerages and analysts, sentiment toward SMCI ranges from neutral to modestly optimistic, though many flag continued risks. KeyBanc assigned a sector‑weight rating, warning that product differentiation remains weak in the crowded and low‑margin server market. They trimmed expectations for revenue growth, forecasting 48 percent for fiscal 2025 and 22 percent for 2026—below the company’s own targets—and expressed concern about concentration risks, with a few large customers accounting for a disproportionate share of revenue. Mizuho Securities maintained a neutral stance, assigning a $50 price target, implying modest upside from current levels, while drawing attention to governance woes and competitive pressures. This rating came after SMCI regained Nasdaq compliance.

But not all analysts are bearish. Raymond James issued an outperform recommendation with a relative target of $41, a call that catalyzed a stunning 36 percent rally over two trading days in mid‑2025. This bullish call stemmed from smci stock’s strategic positioning in the AI infrastructure market, its largely U.S.-based operations mitigating tariffs, and the explosive adoption of NVIDIA’s latest Blackwell architecture. Mizuho also recently raised its target to $47, citing robust AI server demand, a key deal with DataVolt in Saudi Arabia, and expanded supply partnerships with Microsoft-affiliated cloud solution providers.

Stock Volatility Reflects Market Uncertainty

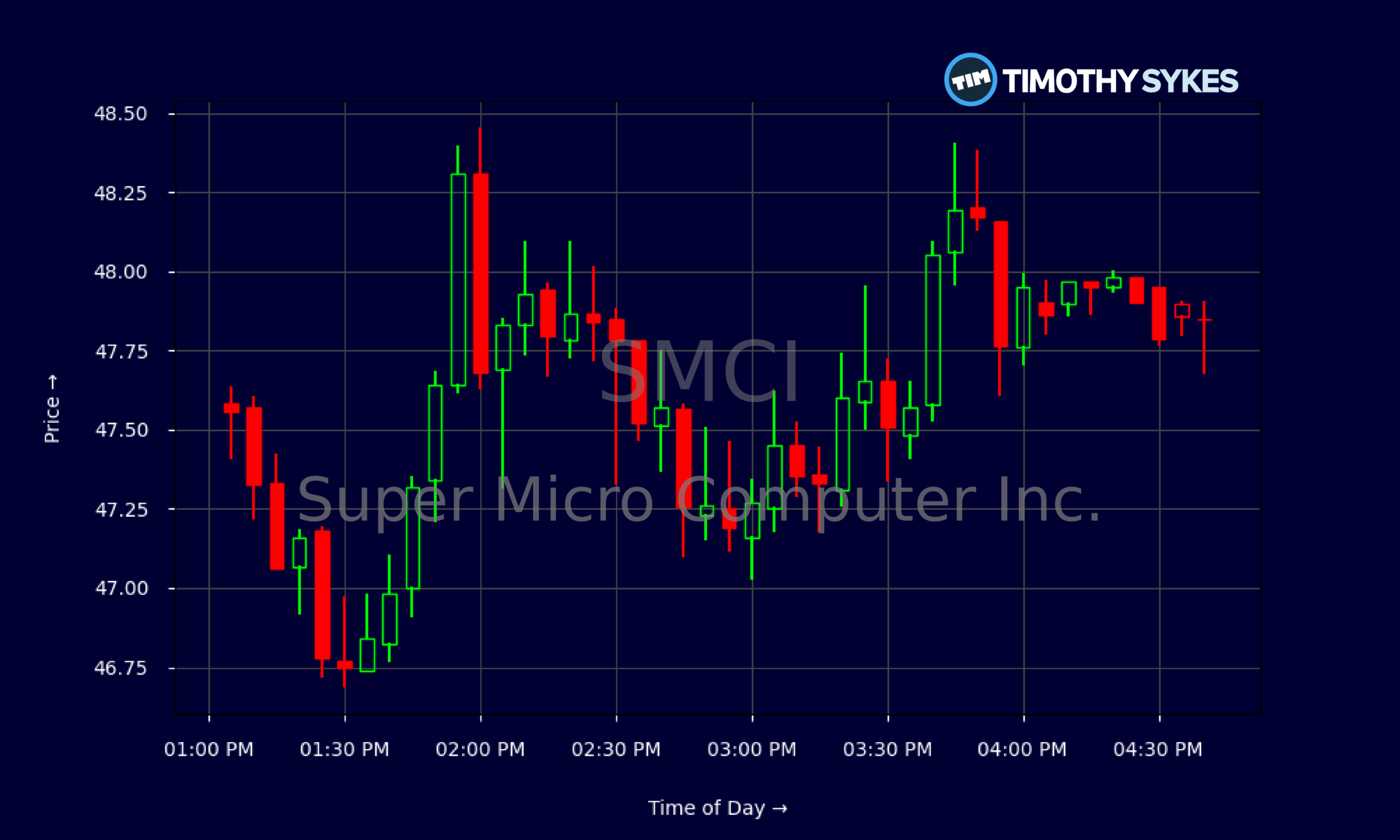

SMCI’s share price has been highly volatile—rallying up to 59 percent year-to-date at certain points, only to suffer sharp declines following earnings misses or regulatory headlines. Intraday trading on August 13, 2025, saw the stock near $46, down slightly from its intraday high and low, and trading with significant volume. Support levels have recently been charted near $35, with resistance as high as $66 to $97, depending on whether bullish sentiment holds or reverses.

Valuation Considerations and Modeling Insights

Valuation models typically reflect a wide range of outcomes for smci stock. Discounted cash flow (DCF) analyses that incorporate aggressive growth assumptions place the stock’s fair value at around $700 by year-end 2025, with confidence intervals stretching from $600 to over $800—suggesting potentially outsized upside if growth materializes. Other modeling approaches using revenue multiples, P/E, EV/EBITDA, and P/FCF ratios reaffirm similar ranges, blending growth premium expectations with comparable sector benchmarks. These estimates hinge on sustained AI demand, margin recovery, and improved operational transparency—and assume macroeconomic stability.

The Road Ahead: Balancing Opportunity and Risk

For investors watching SMCI, the company presents a compelling yet complex opportunity. On one hand, its leadership in AI server hardware, innovation in liquid-cooled systems, and expansion across global data center infrastructure mean it could ride the broader AI wave for substantial gains. On the other, persistent governance issues, margin pressures, customer concentration, and geopolitical tariffs create valid concerns. smci stock s path to regaining credibility may well define whether its current valuation is justified or overly optimistic.

Conclusion

SMCI stock today stands at a crossroads between innovation and skepticism. Revenue continues to surge, buoyed by demand for AI infrastructure and strategic partnerships, while valuation models point toward considerable upside—assuming growth trajectories hold and governance concerns fade. Yet the recent earnings miss and external scrutiny remind investors that, for now, SMCI remains a high‑volatility, high‑risk, high‑reward proposition. For those tracking AI infrastructure plays, SMCI offers one of the more dynamic stories—but only time will tell if it can maintain its current momentum without sacrificing investor trust.

One thought on “SMCI Stock: Riding the AI Wave Amid Governance Skepticism”

Comments are closed.